core advantage

Innovative technology

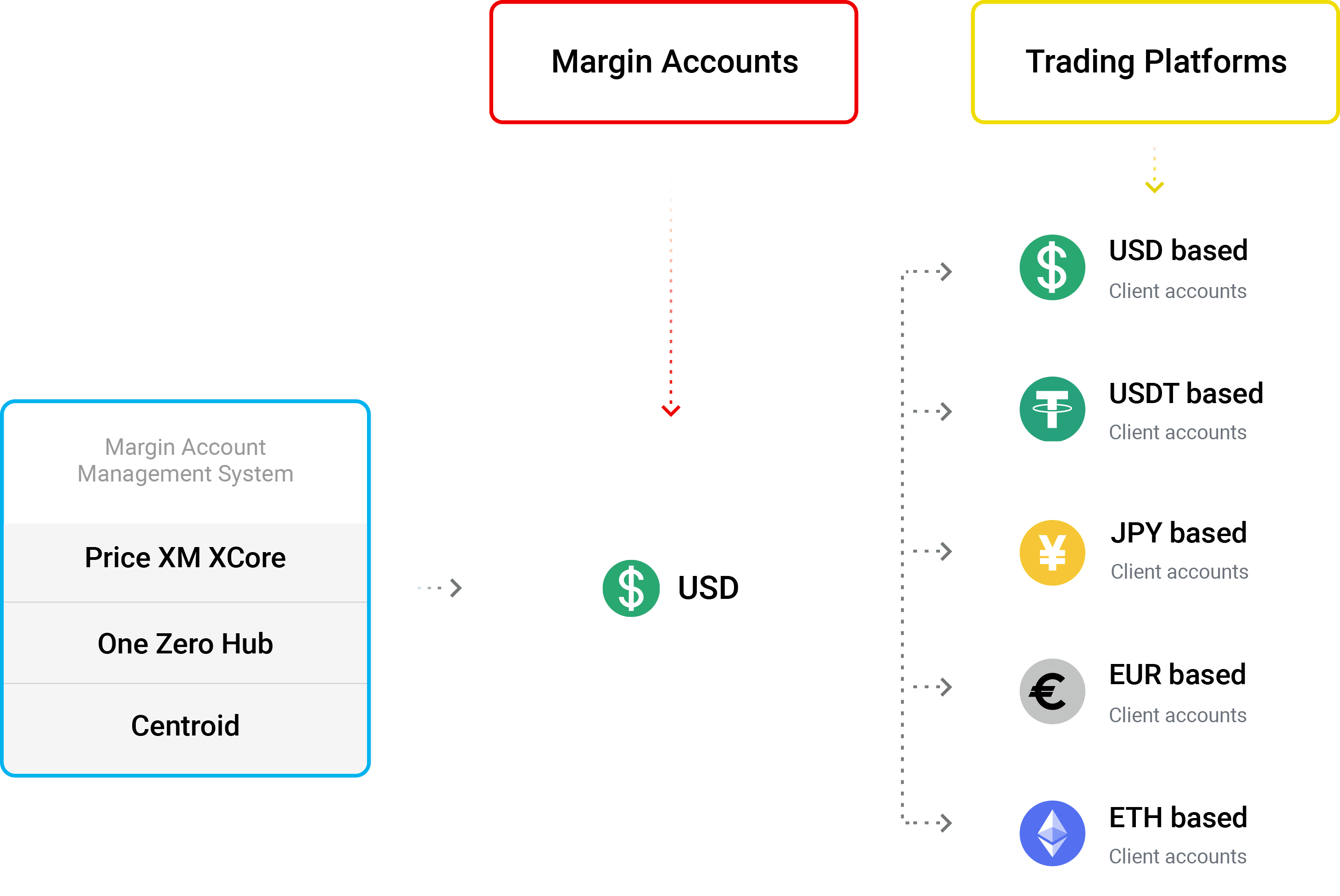

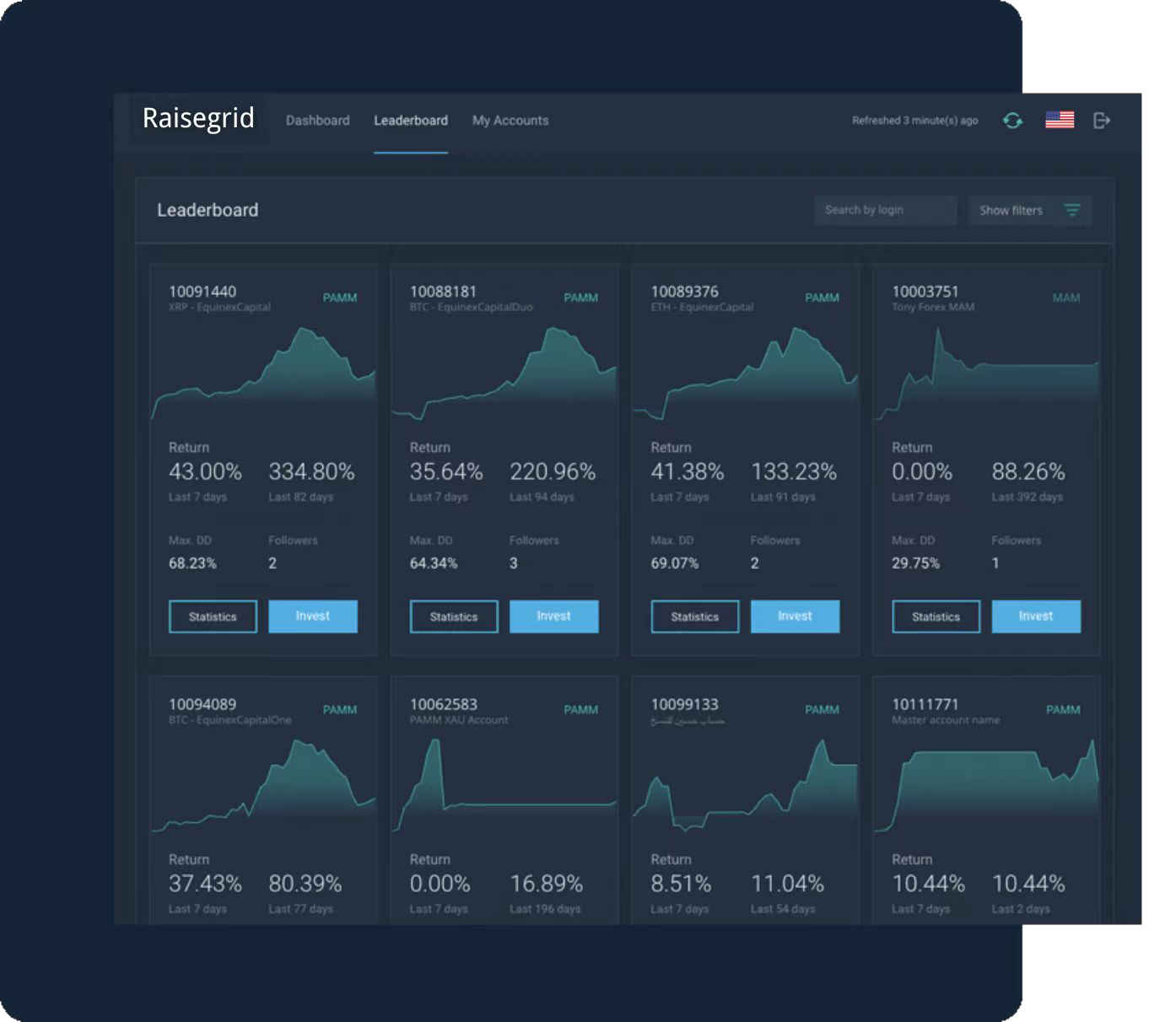

RaiseGrid has significant technological advantages, in artificial intelligence, machine learning and quantum computing. We use state-of-the-art AI algorithms to simulate and predict market behavior, while providing precise strategic responses to complex market movements through deep data analysis of machine learning. In addition, we are exploring the potential of quantum computing to dramatically increase speed and efficiency in solving highly complex computing problems, further consolidating our technological leadership in fintech.

Custom solutions

RaiseGrid Dedicated to providing financial technology solutions tailored to customers' specific needs. Whether facing large financial institutions and individual investors, we are able to flexibly adapt our technology platform to ensure that every customer has the best service for their business needs. Our customized solutions cover a full range of services from asset management to risk assessment to market forecasting to transaction execution, helping customers stay competitive in changing markets.

Industry leaders

As an industry leader in fintech, RaiseGrid has gained wide recognition and professional acclaim worldwide. Not only have our innovations been repeatedly highlighted in various industry conferences and forums, but our leadership team is often invited to speak at the International Fintech Summit to share our advanced technology and market insights. All this is evidence to the important role and industry influence of RaiseGrid in driving fintech progress.

1. Artificial Intelligence (Artificial Intelligence) - -processes 200 TB of trading and market data daily, and is applied to market forecasting and risk assessment.

2. Machine learning (Machine Learning) -Analyze historical and real-time datasets of over 300 TB per month to optimize trading strategies and behavioral pattern recognition.

3. Quantum Computing (Quantum Computing) -The quantum algorithm currently under test is expected to process 500 TB of data for complex computing and optimization problems.

4. Customized Solutions (Custom Solutions) - -Provide customized services to over 100 + financial institutions to manage and optimize their asset portfolios.

5. Industry Influence (Industry Influence) - -affects and attracts over 5,000 industry experts and decision makers to participate and discuss annually through various forums and conferences.

Solutions and services

"RaiseGrid is committed to providing tailored financial technology solutions to meet the diverse needs of our customers worldwide. By leveraging the power of cutting-edge technology, we provide services that can transform financial markets and empower enterprises.”

Quantitative Strategy Development

Professional: We develop customized quantitative models that analyze more than 250 TB of market data every day to help identify buying and selling times and automatically execute transactions. Application: To leverage event-driven strategies and statistical arbitrage to enhance return on investment and market insights.

High-frequency trading solutions

Speed advantage: Our high-end trading platform can handle over 300 TB of trading orders at thousands of levels, ensuring that optimal performance is maintained in extreme market conditions. Technology: Adopt state-of-the-art algorithms and low-latency technologies to improve the speed and accuracy of transaction execution.

Customize your financial solutions

Personalized service: According to the specific needs of customers, we provide accurate and customized asset management and investment strategy, and the asset scale under management reaches $10 BUSD. Technology applications: Use machine learning and predictive analytics to provide customers with data-driven decision support.

Risk management system

Risk control: Our system is able to monitor and assess over 500 TB of portfolio risk data in real time to ensure compliance with international financial compliance standards. Tools: Use advanced statistical models and risk assessment tools to manage market, credit and operational risks.

Industry applications

"RaiseGrid uses its technical expertise to deliver influential solutions to various industries, change the way companies operate and thrive in competitive markets. Our data-driven approach enables customers to leverage the potential of financial technology.”

-

Financial Market analysis (Financial market analysis)

Deep Insight: Processing more than 400 TB of global financial market data every day, providing in-depth market and trend forecasts. Professional tools: Use self-developed analytical tools, such as time series analysis and cross-asset comparison, to help investors grasp the market trends.

-

business intelligence

Data solutions: Provide enterprises with business data solutions that process 120TB per year, supporting a faster decision-making process through enhanced data visualization tools. Optimization: The strategy uses predictive analysis and scenario simulation to help enterprises optimize operational efficiency and cost control.

-

supply chain finance

On-chain financing: Using blockchain technology to process and validate more than 200 TB of transactions to improve supply chain transparency and liquidity. Risk mitigation: Help enterprises to reduce the financial risk in the supply chain through real-time data analysis and credit evaluation model.

-

Insurance technology

Risk assessment: Using big data and AI technology to analyze more than 150 TB of insurance applications and claims data to improve the accuracy and efficiency of risk assessment. Customized insurance products: design personalized insurance products according to user behavior and historical data to meet specific market needs.

-

Energy finance

Market forecast: Analyze about 80 TB of energy market data daily, forecast price fluctuations and supply and demand changes, and support the strategic decisions of energy companies. Investment analysis project: Use machine learning technology to analyze energy return on investment to enhance the efficiency and efficiency of capital allocation.

research and analysis

"At RaiseGrid, we demonstrate our commitment to advancing financial technology through dedicated research and insightful analysis. We explore cutting edge themes to provide our customers and industry with valuable vision to drive innovation and efficiency.”

Main areas of research

Application of the econometric model We use econometrics methods to analyze more than 150 TB of global economic data per year to build forecasting models and market trend analysis.

Learn moreApplication of artificial intelligence in asset management

Our AI research focuses on optimizing asset allocation decisions through deep learning and reinforcement learning techniques, and 300 TB of related data sets have been processed and analyzed.

Learn moreAdvanced algorithm development

The research team is developing a new generation of high-precision trading algorithms that can process and analyze 200 TB of trading data in real-time, identifying small market fluctuations.

Learn moreInsight and analysis report

Global market dynamics Regular release of in-depth analysis reports on global financial markets, covering major market trends and potential investment opportunities. Technology frontier exploration To explore the potential of blockchain and quantum computing in current and future fintech and its possible impact on the market.

Learn moreCooperative partner